Romania is one of the most dynamically developing countries in the European Union. In recent years, tax reforms have been carried out that enable the establishment and development of businesses without excessive tax burdens. Low tax rates and favourable economic conditions have made Romania an attractive place to do business, especially in the IT industry.

IT sector in Romania

Since Romania joined the EU in 2007, the country’s IT industry has grown steadily and attracted significant investors. The main areas that the Romanian IT sector covers include business management, production cycle, development of management systems, applications and services, tools for optimising product design and development, and consultancy.

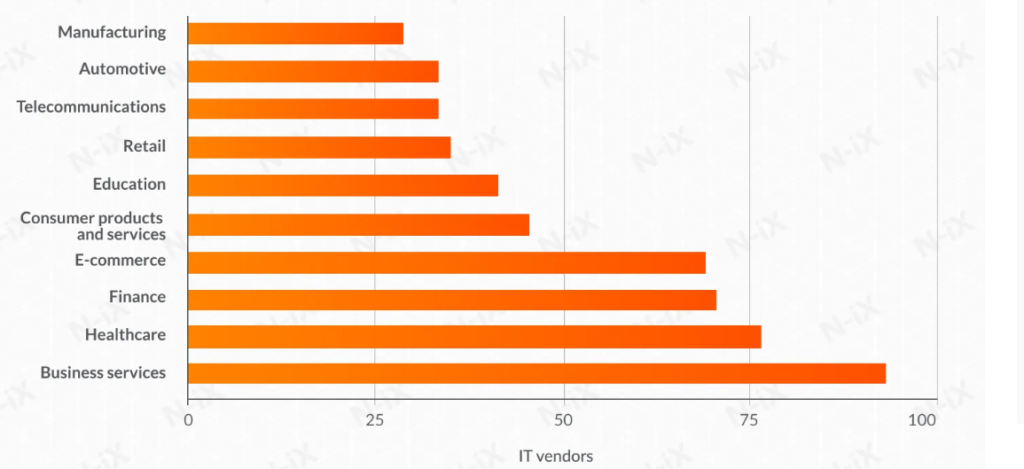

Source: n-ix.com/ Clutch

Romania is the sixth country in the world in terms of qualified IT professionals – thus overtaking Germany and the UK, among others. In the coming years, the IT industry can be expected to be the most important contributor to local GDP growth. It already accounts for almost 6.2 per cent of GDP, which is more than €13.5 billion.

Tax rates for IT companies in Romania

In 2021, more than 191,000 people will be working in the Romanian IT sector, with around 8,000 more employees every year. According to Romanian Insider, there are almost 22,000 companies operating in the IT market, and the last five years have seen an increase of up to 78% in the number of micro-enterprises.

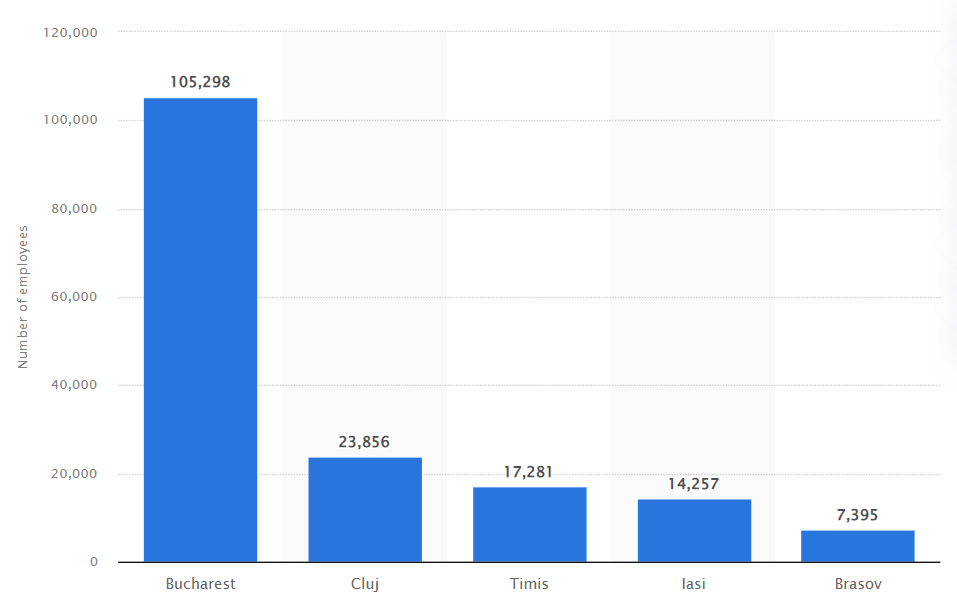

Source: Statista Research Department

In order to maintain the upward trend, Romania offers a number of benefits for the information and technology industry:

- 1% income tax for microenterprises and 16% tax on profits for companies exceeding the turnover of EUR 500 000 per year

- 8% tax on dividends

- exemption from income tax for a period of 10 years (if the companies have a research and development character)

- exemption from PIT on remuneration for the creation of computer software (this possibility may be used by persons working in such positions as e.g. analyst, software systems engineer, programmer, computer systems designer, programmer’s assistant)

- favourable conditions for the depreciation of fixed assets.

Why is it worth setting up an IT company in Romania?

Romanian government on strategy to retain skilled IT professionals in the country and attract new ones. Romania’s optimistic growth prospects – the attractiveness of the market for technology investment, certified professionals, competitive prices and a constantly evolving business environment, as well as the advantages, resulting from tax reforms, among others

- low cost of business maintenance

- low income tax

- low cost of living (compared to other EU countries)

- PIT exemption for employees

- CIT exemption for companies with a research and development profile

are the most important aspects influencing Romania’s affordability as a country to locate an IT company.